Navigating the world of safe savings doesn’t have to be complicated, but it does require a clear strategy. When considering where to park your hard-earned money for growth without the stomach-churning volatility of the stock market, Ideal Scenarios for CD Investments often rise to the top of the list. These aren't just glorified piggy banks; Certificates of Deposit (CDs) are powerful, predictable tools that, when used correctly, can align perfectly with specific financial goals.

But here’s the truth: while CDs offer a comforting predictability, they're not a one-size-fits-all solution. Understanding when and how to deploy them effectively is the key to maximizing their potential and ensuring your money works as hard as it can for you, without surprises.

At a Glance: Smart CD Investing

- Safety First: CDs are FDIC-insured up to $250,000 per depositor, making them one of the safest places for your cash.

- Predictable Returns: You lock in a fixed interest rate for a set term, ensuring you know exactly what your money will earn.

- Goal-Oriented: Best for short to medium-term goals where you can't afford market risk, like a down payment or college savings.

- Shop Around: Rates vary significantly between banks and credit unions; compare online to find the best deals.

- Strategic Staggering: Techniques like CD ladders, barbells, and bullets balance liquidity with higher long-term yields.

- Mind the Liquidity: CDs penalize early withdrawals, so ensure you have an emergency fund elsewhere.

- Beyond Traditional: Explore bump-up, no-penalty, or jumbo CDs for specialized needs.

Understanding the CD Landscape: Why Lock in Your Money?

Imagine a savings account that promises a specific return, come what may, for a set period. That’s essentially a Certificate of Deposit. Offered by banks and credit unions, a CD is a type of savings account where you agree to keep an initial deposit untouched for a fixed term—anything from three months to five years, or sometimes even longer. In exchange, you get a fixed interest rate that's generally higher than what a standard savings account offers.

The core appeal of CDs, as a Gainbridge® study highlights, is clear: 71% of people choose them for their low risk, 65% value the fixed rates and predictable returns, and 57% appreciate the higher rates compared to traditional savings accounts. This combination makes them particularly attractive for individuals who prioritize capital preservation and guaranteed growth over market-driven speculation. Your money is also safe, with FDIC insurance covering up to $250,000 per depositor, per institution, in case of bank failure.

However, this predictability comes with trade-offs. The "lock-in" feature means limited liquidity; withdrawing funds before the CD matures typically incurs a penalty, often several months' worth of interest. Additionally, while fixed rates are reassuring, they can be a double-edged sword. They might not keep pace with inflation over longer terms, eroding your purchasing power. And unlike investments in the stock market, like the S&P 500 which has historically delivered annual returns exceeding 15% in strong periods, CDs won't participate in those significant market gains. This means CDs are a strategic choice, not a universal one.

Pinpointing Your Perfect Match: When CDs Shine Brightest

CDs aren't just for everyone; they're for specific financial moments and temperaments. Understanding these ideal scenarios helps you leverage their unique strengths.

For Your Short-Term, Non-Negotiable Goals

Have you ever saved for something big, only to watch market fluctuations erode your progress just when you needed the funds? CDs eliminate that risk for crucial short-to-medium term objectives. If you're planning for a down payment on a house in two years, saving for a new car next year, or accumulating tuition money for a child starting college in three years, CDs offer a sanctuary. Your principal is protected, and the interest rate is locked in, guaranteeing your funds will be there, with a predictable boost, when it's time to spend.

Preserving Capital While Earning Predictable Growth

For risk-averse investors, or those nearing retirement who need to protect their nest egg from market downturns, CDs are invaluable. They provide a secure haven for a portion of your wealth, allowing it to grow steadily without exposure to market volatility. While the returns might not be as high as potential stock market gains, the certainty of those returns is often worth the trade-off for those prioritizing safety. It's about protecting what you have and ensuring it grows, albeit modestly, rather than risking a decrease in value.

Leveraging High-Interest Rate Environments

This is where smart timing truly pays off. When interest rates are high, locking in those attractive yields with a CD can be incredibly advantageous. For example, some top CDs exceeded 5% as of July 15, 2024, significantly higher than the average 5-year rate of 1.40%. If experts predict rates will fall in the future, securing a high-rate long-term CD now means you continue to earn that superior rate even as new CD offerings decline. It's like catching a wave at its peak and riding it out for several years.

Diversifying Your Portfolio for Stability

Even aggressive investors often benefit from a diversified portfolio that includes lower-risk assets. CDs can act as a stable, fixed-income component, balancing out the higher volatility of stocks or other growth investments. They provide a predictable bedrock, offering peace of mind and reducing overall portfolio risk, especially during turbulent economic periods. This strategy ensures that not all your eggs are in one basket, and you have a secure, growing asset to rely on.

Parking Cash Safely for Future Decisions

Sometimes you have a lump sum of money, but you're not entirely sure what its ultimate purpose will be in the next few years. Maybe you're selling a business, receiving an inheritance, or just want to take a break from active investing. Parking these funds in a CD allows them to earn a better return than a traditional savings account, without subjecting them to market risk. You gain some growth while giving yourself time to make a well-thought-out long-term financial plan, knowing the funds are safe and accessible (with a penalty) if an unforeseen opportunity arises.

Mastering Your CD Strategy: More Than Just Picking a Term

Simply buying a single CD won't always cut it. Savvy investors use a range of strategies to optimize their returns, balance liquidity, and navigate changing interest rate environments.

The Fundamentals: Shopping Around & Tailoring Terms

Before diving into advanced tactics, start with the basics.

- Shop Around for the Best CD Rates: Rates can vary dramatically between financial institutions. Don't just settle for your primary bank's offerings. Online banks, in particular, often provide more competitive rates because they have lower overhead costs. A few minutes of comparison shopping can add significant interest earnings over the life of your CD.

- Choose CD Terms Based on Liquidity Needs: This is paramount. If you know you'll need funds for a specific goal in 18 months, a 2-year CD might be too long, potentially forcing an early withdrawal penalty. Conversely, if you're saving for something five years out, a 6-month CD means you'll repeatedly have to find new accounts and potentially lower rates. Match the CD term as closely as possible to when you anticipate needing the funds.

The Power Trio: Advanced CD Strategies

These strategies help you gain flexibility and potentially higher yields.

CD Laddering: Balancing Access and Yield

A CD ladder is perhaps the most popular advanced CD strategy, offering a clever way to blend liquidity with the higher rates often associated with longer-term CDs.

- How it Works: Instead of putting all your money into one CD, you divide your investment into multiple CDs with staggered maturity dates. For example, if you have $50,000, you might invest $10,000 each in a 1-year, 2-year, 3-year, 4-year, and 5-year CD. As each CD matures annually, you have a choice: access the funds if you need them, or reinvest them into a new long-term CD (e.g., another 5-year CD).

- Benefits: This method ensures you have a portion of your funds becoming liquid regularly, avoiding early withdrawal penalties. It also allows you to take advantage of potentially rising interest rates by reinvesting matured CDs at current, higher rates, while still benefiting from the better yields of longer-term CDs. It's an excellent way to average out interest rates over time.

- Drawbacks: Your initial returns might be slightly lower than if you had simply invested everything in a single, high-yield long-term CD. It also requires a bit more management to track maturity dates and make reinvestment decisions.

CD Barbell: Flexibility in Fluctuating Markets

The CD barbell strategy is for those who are watching interest rate trends and want to position themselves for potential rate changes.

- How it Works: You divide your investment into just two CDs: one short-term (e.g., 6 months or 1 year) and one long-term (e.g., 5 years). For instance, you might put half your money in a 1-year CD and the other half in a 5-year CD.

- Benefits: This strategy offers the best of both worlds. The short-term CD provides liquidity and allows you to reinvest those funds relatively soon, potentially at higher rates if interest rates rise. Meanwhile, the long-term CD locks in a higher rate for a significant portion of your money, providing stability. If rates are expected to climb, the barbell is particularly effective, as you'll have funds freeing up soon to catch those new, better rates.

CD Bullet: Hitting a Target Date

The CD bullet strategy is ideal for a specific, future lump-sum need, ensuring all your funds mature simultaneously.

- How it Works: You invest in multiple CDs over time, but all are structured to mature on the same future date. For example, if you need a lump sum in five years, you might buy a 5-year CD today. Next year, you'd buy a 4-year CD. The year after, a 3-year CD, and so on. By the fifth year, all your CDs will mature together, providing a single large payout.

- Benefits: This method is perfect for time-specific goals like a college tuition payment, a large down payment on a home, or funding a future business venture. It ensures a large sum is available precisely when you need it, often combining elements of liquidity (as you invest over time) with the higher yields typically found in longer-term CDs.

Locking in Value: The Long-Term Play

Sometimes, the simplest strategy is the best. If current CD rates are exceptionally high (remember, some top CDs exceeded 5% recently, far above the average 5-year rate of 1.40%), and economic forecasts suggest rates are likely to drop, purchasing long-term CDs to lock in those favorable rates can be a shrewd move. This provides stability and guaranteed better returns over time, shielding you from future rate declines. It's a strategic defensive play to secure higher income.

The Compounding Advantage: Reinvesting Your Returns

Don't let your interest sit idle! When your CDs mature, or if you have CDs that pay out interest periodically, reinvesting those proceeds into new CDs can significantly boost your overall earnings. This takes advantage of compound interest, where your interest itself starts earning interest. Over time, this snowball effect can lead to substantial growth, especially if you consistently reinvest and potentially catch rising interest rates with each new CD.

Decoding CD Options: Beyond the Traditional Account

While traditional CDs are the most common, the market offers several variations designed to cater to different needs and risk tolerances.

- Traditional CDs: These are the straightforward, no-frills CDs: a fixed interest rate, a set term, and an early withdrawal penalty. They are the benchmark for safety and predictability.

- Bump-Up CDs: Also known as "step-up" CDs, these offer a unique flexibility. If market interest rates rise during your CD's term, you're usually allowed a one-time request to "bump up" your APY (Annual Percentage Yield) to the new, higher rate offered by your bank. This provides some protection against rising rates without fully sacrificing the fixed-rate stability.

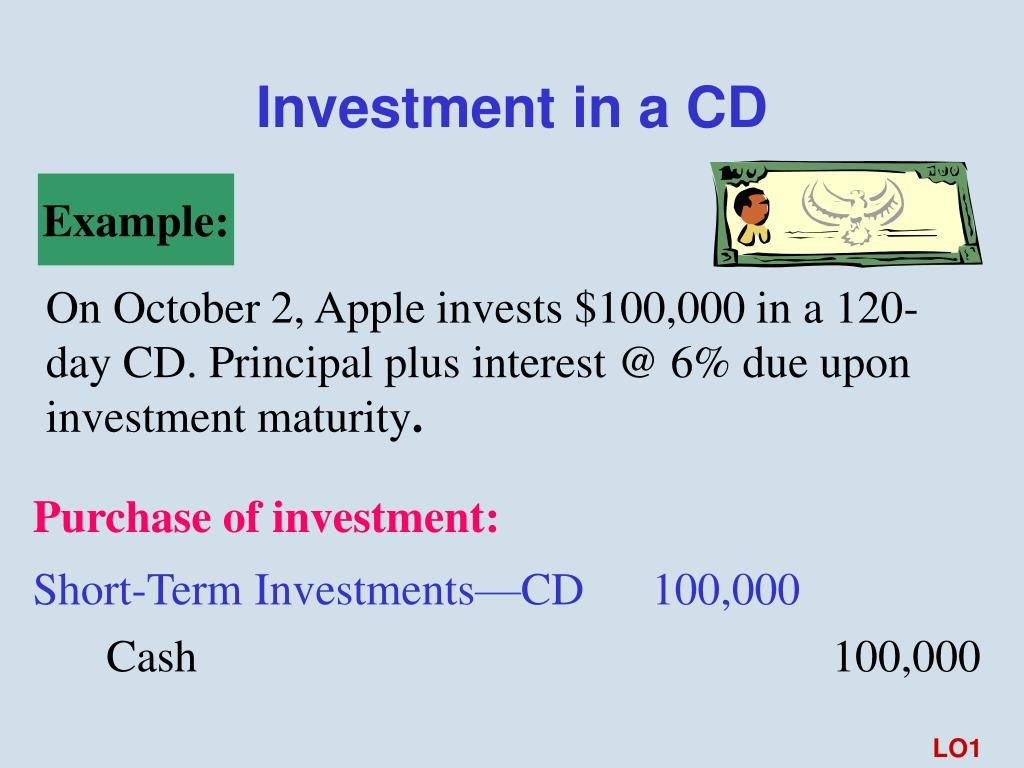

- Jumbo CDs: These require a significantly larger minimum deposit, typically $100,000 or more. In exchange for this larger commitment, banks often offer slightly higher interest rates than standard CDs, making them attractive for high-net-worth individuals or institutional investors.

- No-Penalty CDs: As the name suggests, these CDs allow you to withdraw your money before maturity without incurring any early withdrawal penalties. This offers greater liquidity than traditional CDs, but the trade-off is typically a lower interest rate compared to a similar-term traditional CD. They can be a good choice if you're uncertain about needing access to your funds but still want a better rate than a high-yield savings account.

- Variable CDs: Unlike traditional CDs with a fixed rate, variable CDs have an interest rate that changes periodically based on a specific market benchmark (e.g., the prime rate or a Treasury yield). These can be appealing if you expect rates to rise significantly, but they also carry the risk of rates falling, leading to lower earnings. They introduce more uncertainty than a fixed-rate CD.

Crucial Checks Before You Commit: Avoiding Pitfalls

Before you lock away your money in a CD, take a moment for these vital considerations. A thoughtful approach now can save you headaches later.

Your Emergency Fund Comes First

This is non-negotiable. Before you even think about buying a CD, ensure you have a robust emergency fund – typically 3 to 6 months' worth of living expenses – readily accessible in a liquid account like a high-yield savings account or money market account. CDs are great for growth, but their early withdrawal penalties mean they are not suitable for emergency cash. Dipping into a CD for an unexpected expense defeats its purpose and can cost you money.

Understanding the Fine Print

Every CD comes with a contract, and it's essential to read it thoroughly. Pay close attention to:

- Early Withdrawal Penalties: Exactly how much interest will you forfeit if you need your money early? This is critical for assessing risk.

- Compounding Frequency: How often is interest calculated and added to your principal? Daily, monthly, quarterly, or annually? More frequent compounding can lead to slightly higher overall returns.

- Minimum Deposit Requirements: Do you meet the minimums, especially for jumbo CDs?

- Automatic Renewal: Does the CD automatically renew at maturity? If so, what is the new term and interest rate? If you don't want it to renew, you'll need to instruct the bank.

Inflation's Shadow

While CDs offer predictable nominal returns, it's crucial to acknowledge the impact of inflation. If the inflation rate exceeds your CD's interest rate, your purchasing power will actually decrease over time. For example, if your CD earns 2% and inflation is 3%, your money is losing value in real terms. CDs are best for preserving nominal capital and providing a modest, guaranteed return, not necessarily for aggressive real growth, especially over very long terms or during periods of high inflation.

When to Look Elsewhere: Exploring CD Alternatives

CDs are excellent for specific situations, but they aren't the only option for low-risk savings and income. Understanding alternatives helps you build a truly optimized financial plan.

- High-Yield Savings Accounts (HYSAs): These accounts offer interest rates significantly higher than traditional savings accounts, often comparable to shorter-term CDs. Their primary advantage is superior liquidity: you can access your money at any time without penalty. Like CDs, HYSAs are FDIC-insured. They are an excellent choice for emergency funds, short-term savings, or money you might need on short notice.

- Money Market Accounts (MMAs): Think of MMAs as a hybrid between a savings account and a checking account. They offer interest rates generally better than traditional savings accounts (sometimes competitive with HYSAs) and provide limited check-writing capabilities and immediate access to funds. They typically require higher minimum balances than HYSAs.

- Bonds: These are debt securities issued by governments or corporations. When you buy a bond, you're essentially lending money to the issuer, who promises to pay you periodic interest and return your principal at maturity. Bonds are subject to market performance (their value can fluctuate before maturity) and are not FDIC-insured. They offer diversification benefits but carry more risk than CDs.

- Annuities: These are financial products typically offered by insurance companies, designed to provide a steady stream of income, often in retirement. Annuities can offer more flexible withdrawal options and potentially higher earnings than CDs, but they are also more complex, come with various fees, and can have surrender charges if you withdraw money too early. They are generally not FDIC-insured (though the insurance company itself is regulated) and are best suited for long-term income planning.

Your Next Move: Building Your CD-Powered Future

Armed with this knowledge, you're ready to make informed decisions about whether and how CDs fit into your financial ecosystem. The key takeaway is always to align your investment choices with your personal financial goals, your timeline, and your comfort with risk.

Start by assessing your current financial situation:

- Do you have an emergency fund? If not, prioritize building one in a high-yield savings account before considering a CD.

- What are your financial goals for the next 1-5 years? Identify any specific large purchases, tuition payments, or capital preservation needs.

- What's your risk tolerance for those funds? If you cannot afford to lose a single dollar, CDs are a strong contender.

- What are current interest rates doing? Are they high, low, or expected to change? This will influence your strategic choices (e.g., long-term lock-in vs. laddering).

Then, explore the various CD types and strategies discussed here. Visit online banks and credit unions to compare rates. Don't be afraid to mix and match strategies—perhaps a CD ladder for your child's college fund and a no-penalty CD for a portion of your emergency savings that exceeds your immediate needs.

CDs are not the flashiest investment, but their unwavering commitment to safety and predictable growth makes them an indispensable tool in a well-rounded financial strategy. By matching the right CD scenario and strategy to your unique goals, you can build a more secure and prosperous future, one guaranteed return at a time.